NioCorp announces that its principal Canadian regulator, the Ontario Securities Commission, has approved an extension to file the Company’s third quarter financial statements for the period ended March 31, 2023, the related management’s discussion and analysis, and the CEO and CFO certifications relating to the third quarter financial statements through to May 23, 2023.

NioCorp announced today that Fernanda Reda Fenga Viana Klamas has resigned from the NioCorp Board of Directors because of an inability to commit the necessary time to serving on the Board.

NioCorp announced today that it anticipates a delay in filing its quarterly financial statements for the three and nine months ended March 31, 2023 before the May 15, 2023 deadline.

NioCorp (Nasdaq: NB; TSX: NB) has closed its previously announced registered direct offering of an aggregate of 314,465 common shares for aggregate gross proceeds to the Company of approximately US$2.0 million, before deducting Offering expenses payable by the Company.

NioCorp has entered into a definitive agreement with a fund managed by Kingdon Capital Management, LLC for the sale of an aggregate of 314,465 common shares in a registered direct offering at a price of $6.36 per share for aggregate gross proceeds to the Company of approximately US$2.0 million, before deducting Offering expenses payable by the Company.

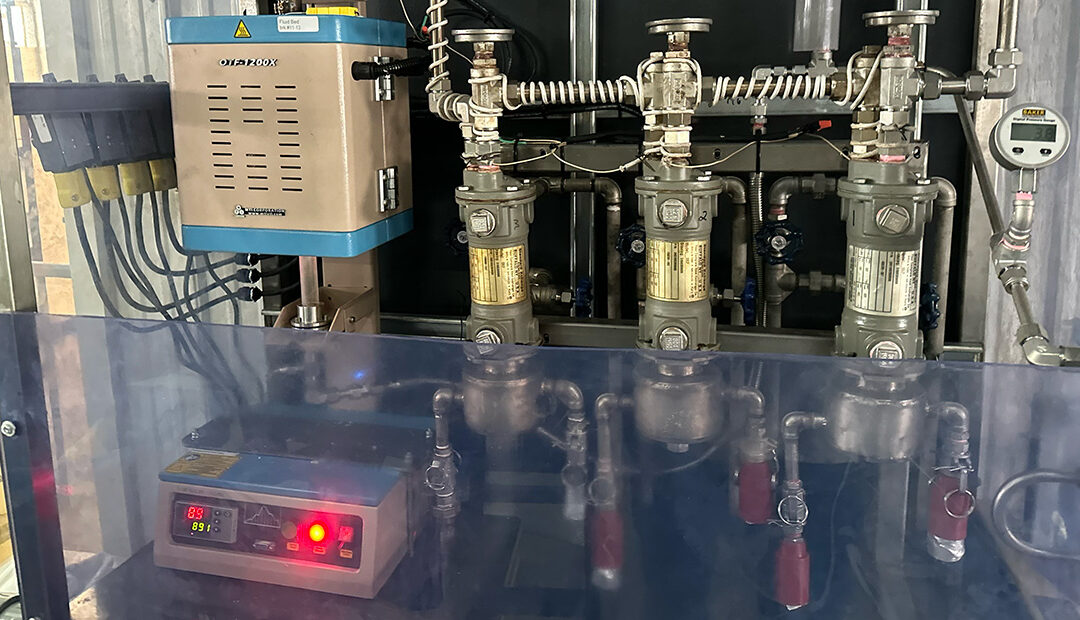

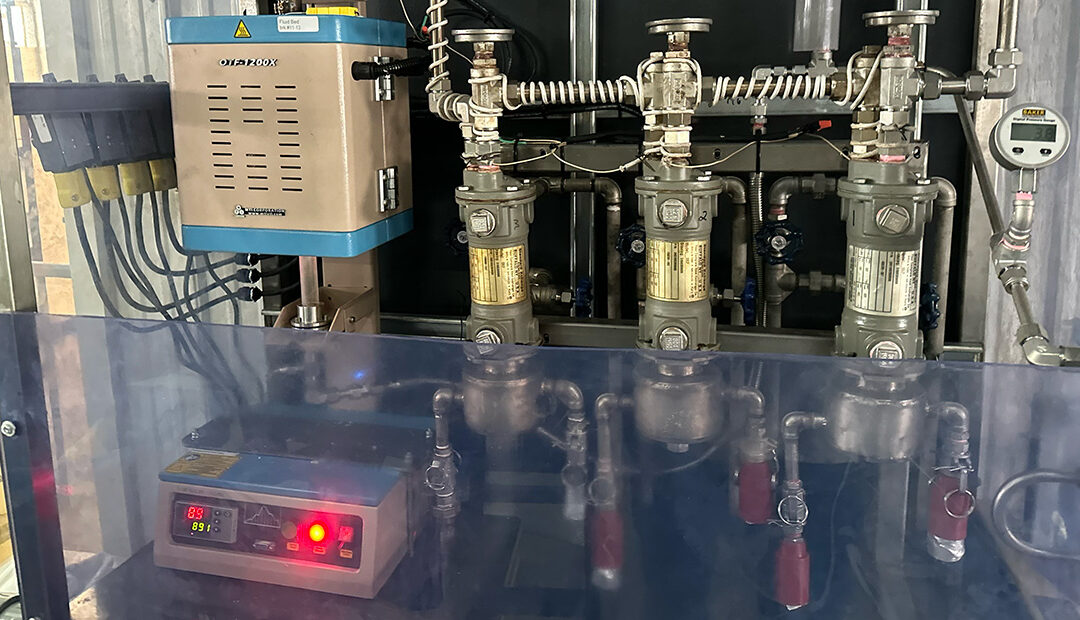

NioCorp (Nasdaq:NB; TSX: NB) and L3 Process Developments are pleased to announce a process breakthrough in niobium and titanium recovery achieved at L3’s demonstration-scale processing plant Trois-Rivieres, Quebec.